PROBLEM

People struggle to save. According to the FCA, 50% of UK adults are financially vulnerable:

-

1 in 4 families have less than £95 worth of savings.

-

50% would struggle with a financial shock.

-

17% of UK adults would struggle with a £50 monthly bill increase.

Barriers to saving:

-

don’t know how to save.

-

day to day financial challenges take priority over putting money aside.

-

constrained finances, so can’t set aside significant amounts.

Fintech’s tend to tell people their current situation, they don't offer actionable avenues to help. We wanted to see whether we could find an actionable way to really help these customers.

How could we do this?

-

providing a simple way which requires little additional thought.

-

make it easy to start.

-

fit in with my level and ability to save.

The 3rd party agency that outlined the above problem, continued to create multiple concepts and find out which had great potential with customers.

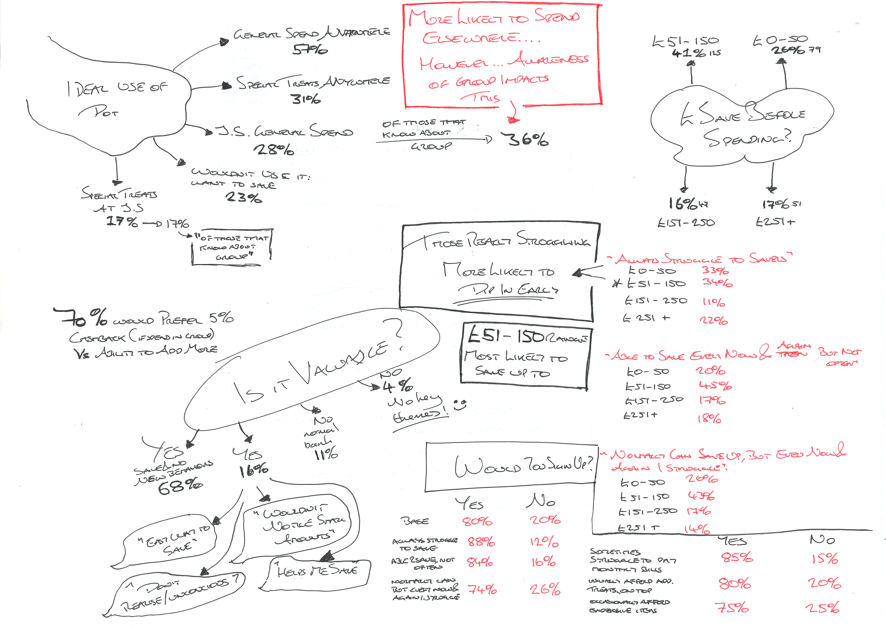

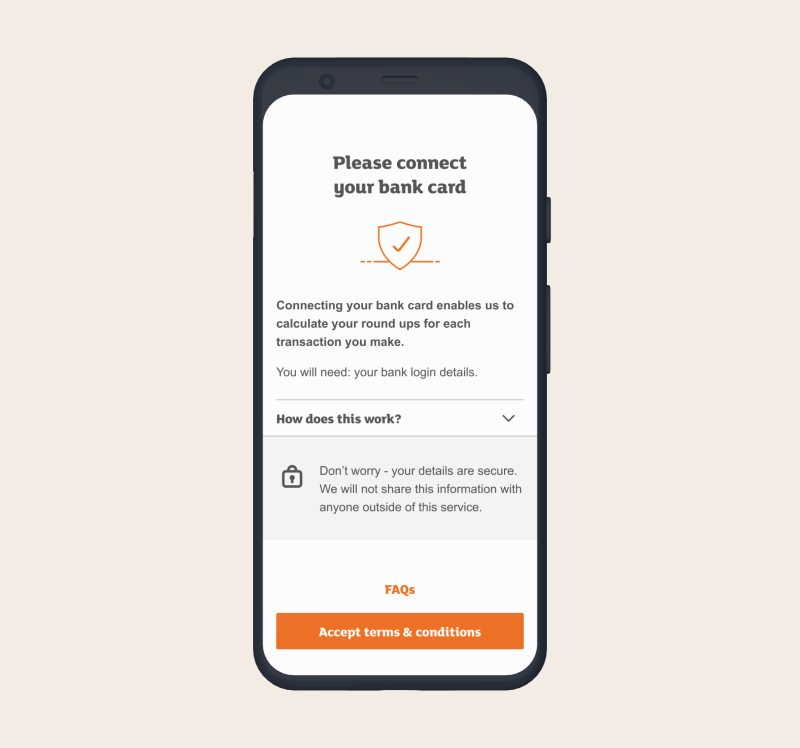

This is how Round Ups was born...Customers link a debit card, and Sainsbury's round up every transaction made on that card and put it in a Sainsbury's pot.

The question was, how could we technically make this work. This is where the Sainsbury’s Digital Experience team were brought in.

SERVICE DESIGN BLUEPRINT

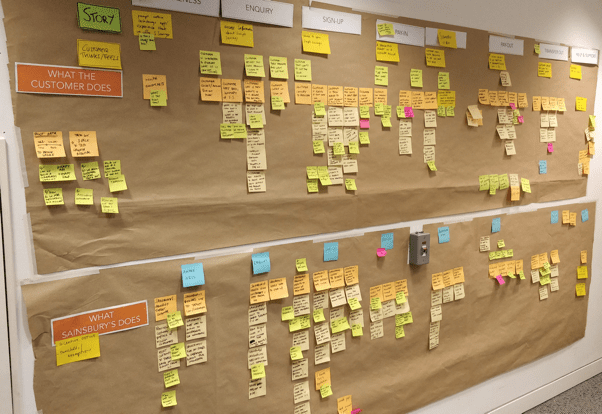

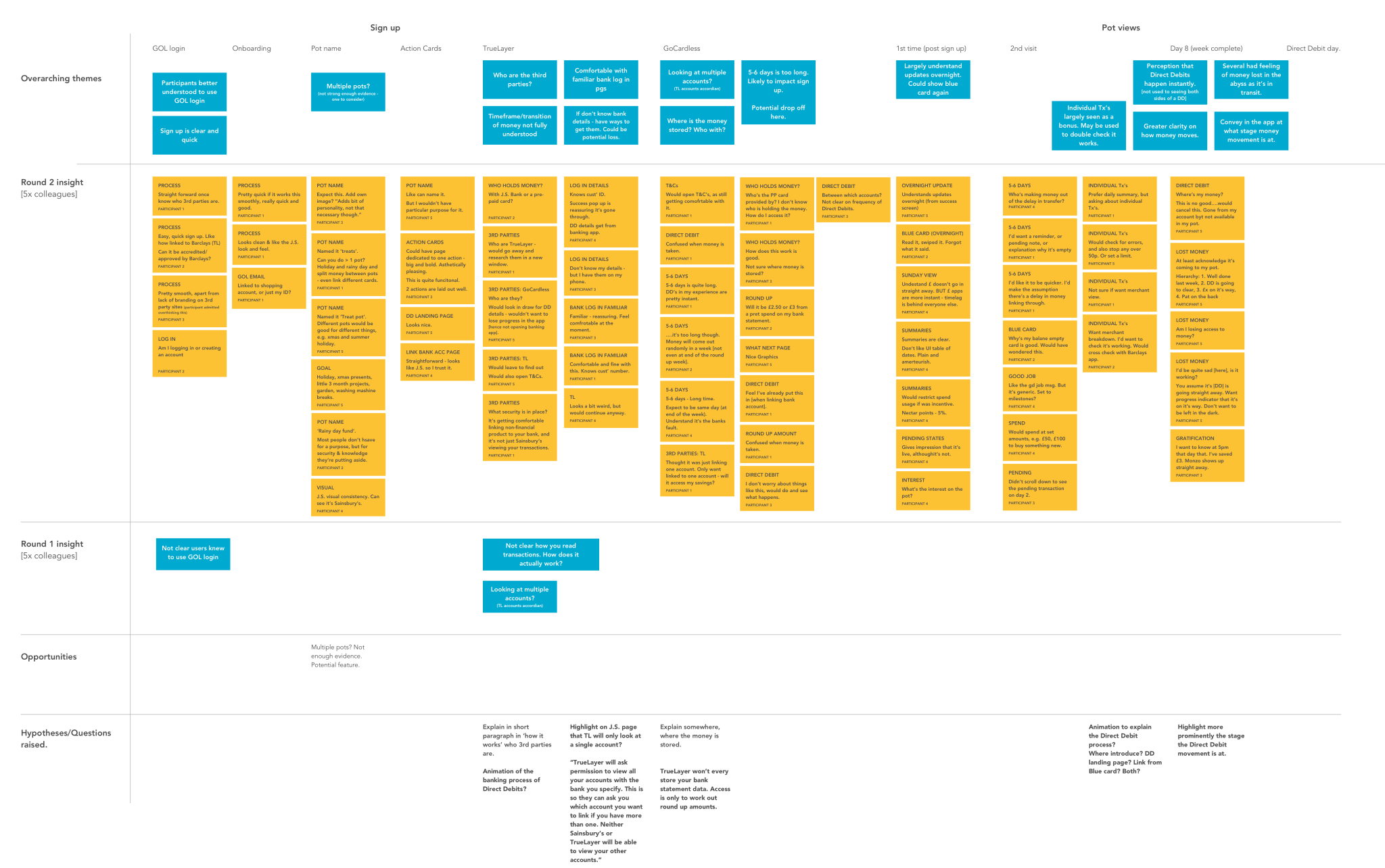

The Product Owner and I, with involvement of the Back End, Front End developers and Solution Architect, created a service design blueprint. Core to this was working out how it would work with the 3rd party fintechs we were reliant on.

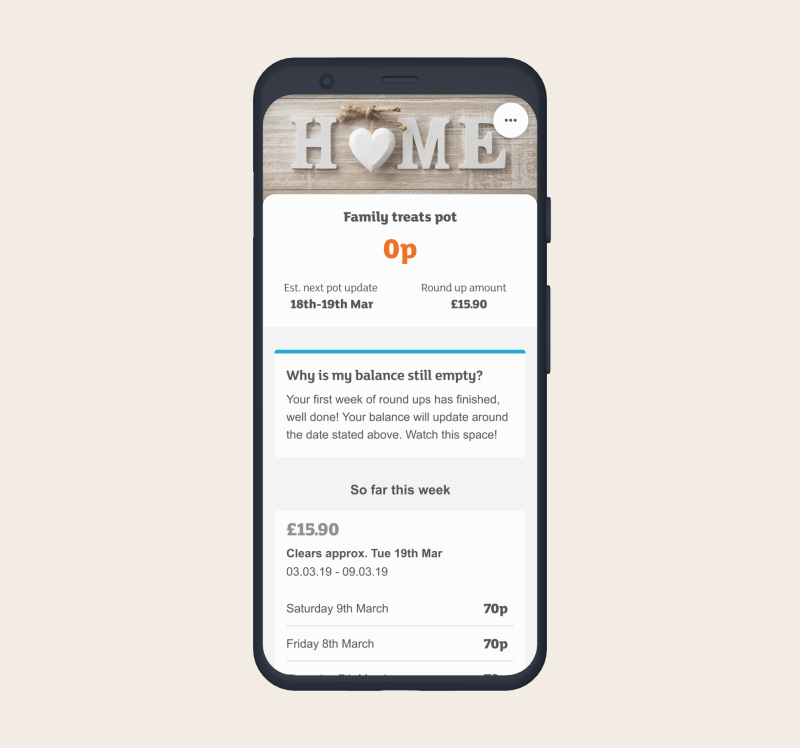

The reality of rounding up each customer transaction as it happened and depositing it in a pot was unrealistic as the mechanism to move money (direct debit) was expensive. As such, the little and often nature of round ups would have to be a weekly direct

Designing around constraints would be a common theme in this project

DIARY STUDY

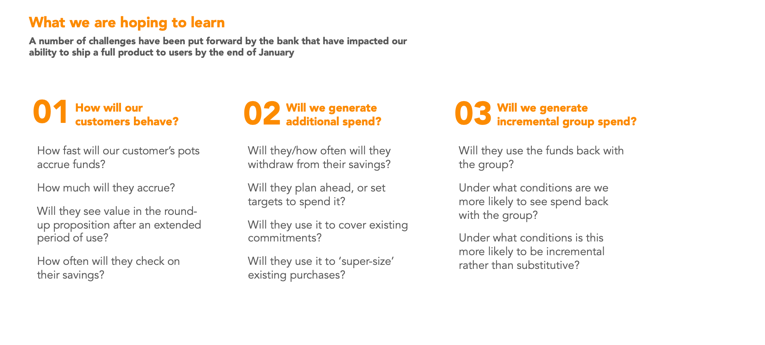

Although initial research was done at a conceptual level, we had some key questions that we needed to answer before going too much further:

-

How much will people realistically round up based on their transactions?

-

Is this amount viewed as useful to customers?

-

At what interval will they withdraw their savings?

-

How will customers use their savings?

-

What customer behavior drives the greatest potential for incremental group spend?

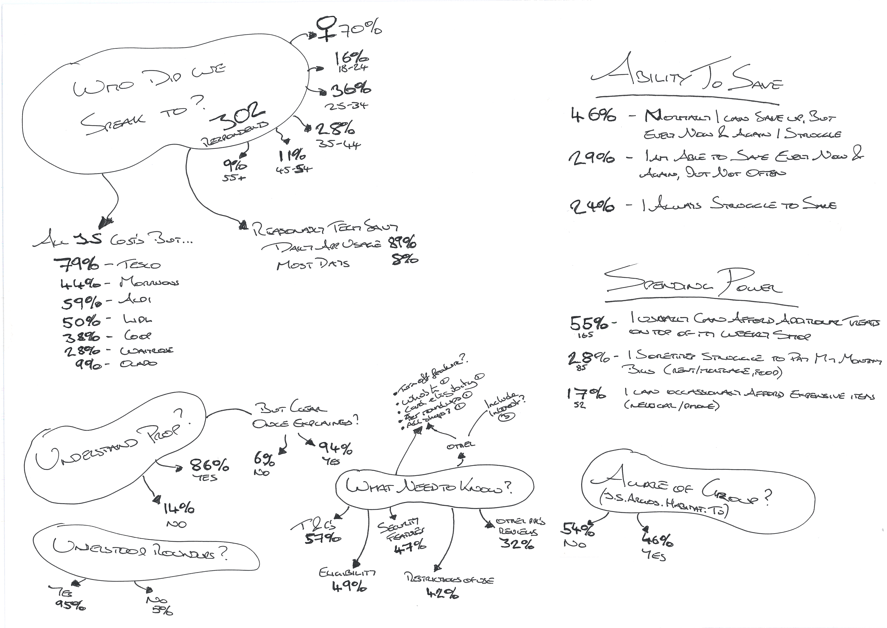

We wanted to run a diary study to answer these questions, but as we didn’t have a live product to do this with, we recruited participants who use similar propositions, such as Monzo Coin Jar and MoneyBox.

We ran this study for 30 days, asking participants to answer a short questionnaire each week detailing how much their round ups were, whether they had withdrawn money and if so, what for and was this the original purpose of the pot.

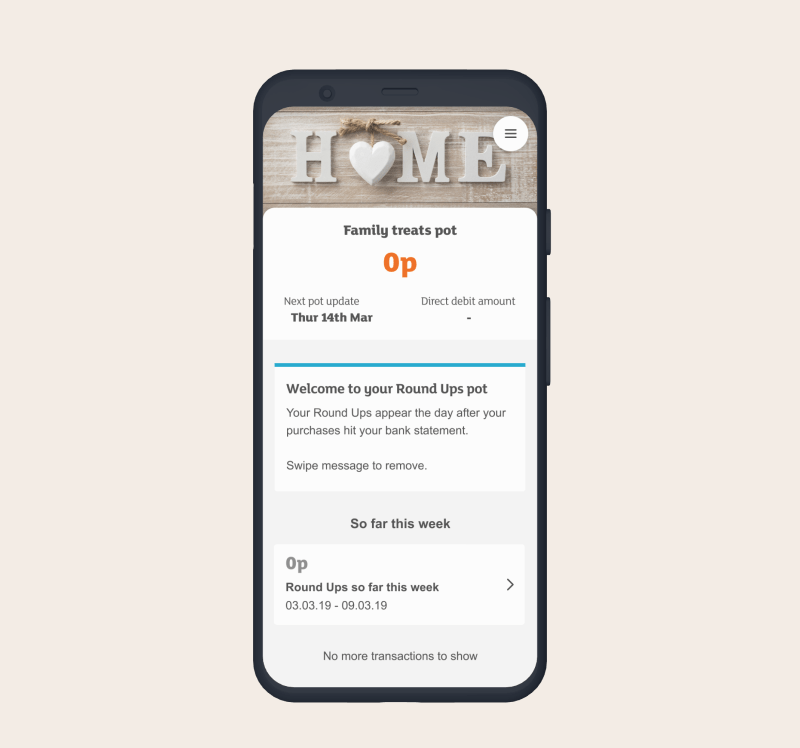

MVP DESIGN

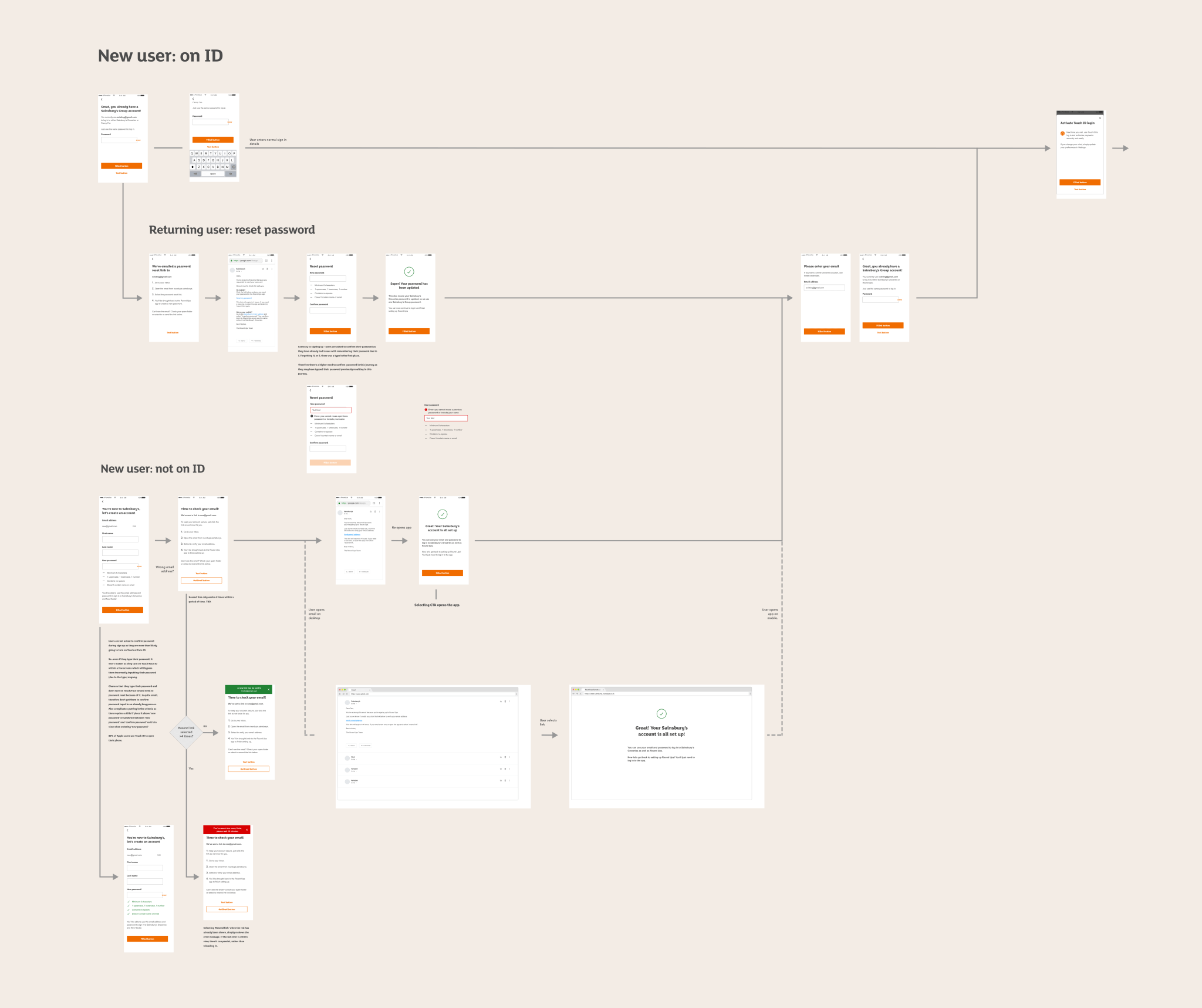

Once we had some confidence that customers saw value in the amount they could realistically save via round ups, I started the design work. At this point I was the sole designer on the product so looked after both the UX and UI.

My usual and preferred way of starting any design work is paper and pen, so I sketched out some initial end-to-end flows and specific screens based on the Service Design Blueprint. However, I quickly moved to digital design in Sketch as the use of the Luna design system made this quicker than sketching out every single page on paper.

PROPOSITION & DESIGN RESEARCH

As we had a base level of design work - I ran UserZoom surveys (which included snippets of the log in design work) and also depth interviews.

Key questions to answer were:

-

will customers link their bank card with Sainsbury’s?

-

how do they feel about linking their bank card?

-

will customers trust Sainsbury’s Groceries to handle money?

DESIGN ITERATION

The insight highlighted key issues:

-

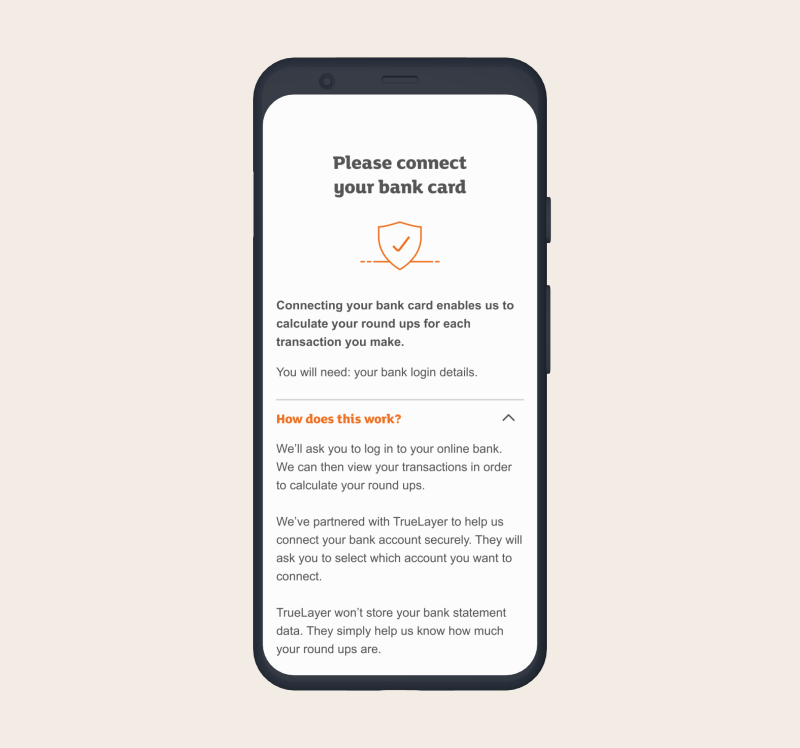

more information required on the third parties.

-

weekly direct debits were problematic as it went against expectations.

-

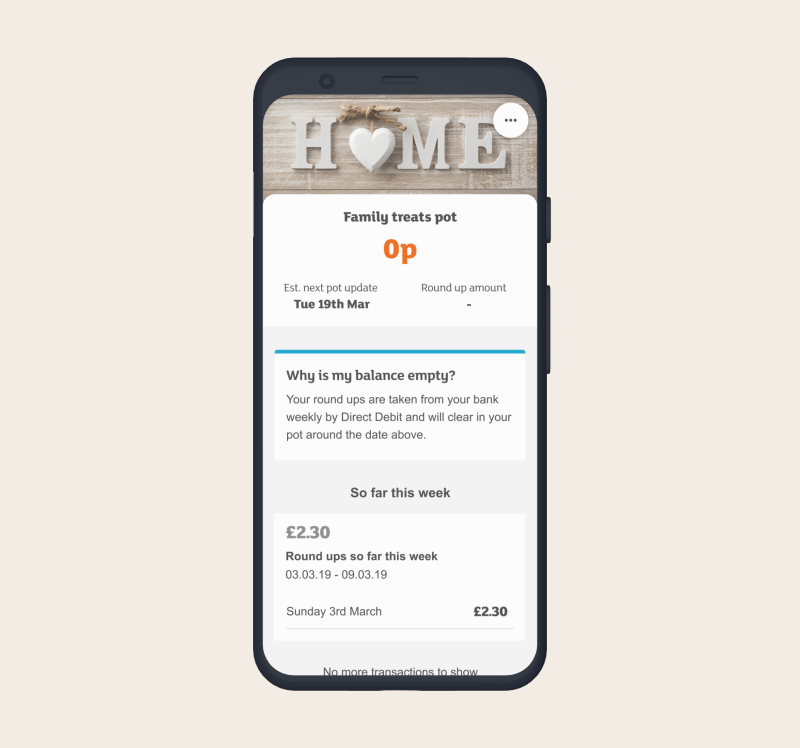

how do we explain the delay in direct debit arriving as well as other nuances.

Blue tip cards were introduced at specific points that caused confusion, due to restrictions with the 3rd party technology.

DESIGN ITERATION RESEARCH

I organised and ran a further 10x depth interviews focusing on the themes that arose in the previous research; not understanding how the proposition really worked, and whether a weekly direct debit would be too much of a financial strain, neither of which surfaced again.

All users understood how the proposition worked, even though it went against their preconceptions and believed a weekly round up of c.£5-6 per week wouldn't be noticed.

This insight furthered our confidence that even with 3rd party technical restraints, the proposition was still attractive to users, and that we should continue. Obviously full confidence would come from the product being live.

NEW FEATURE PRIORITISATION

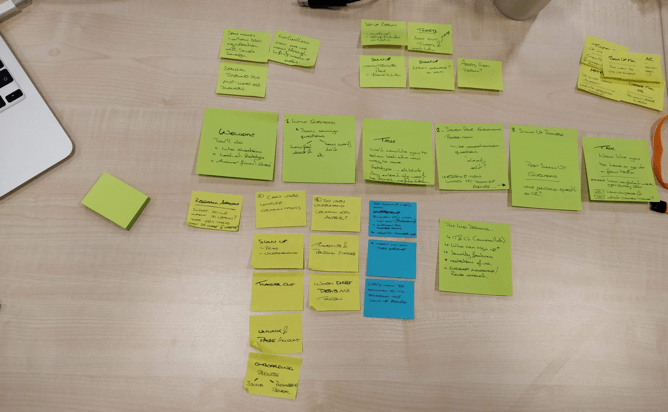

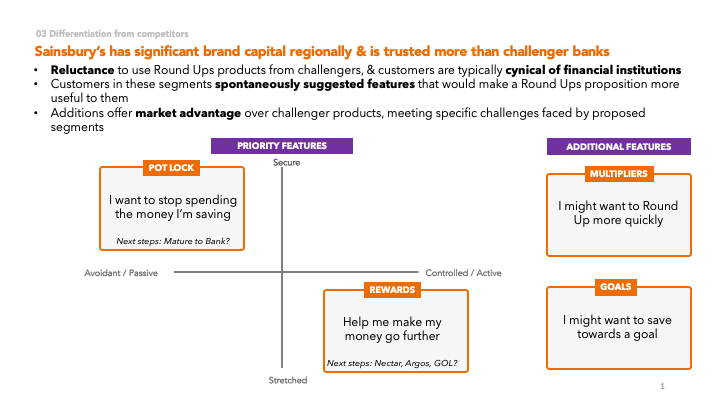

As we were getting closer to release the beta trial, we wanted to look at how we could add more value to customers to make this proposition really stand out to customers.

Previous research had highlighted some key additional features that could do this.

The team got together to discuss these options, keeping in mind the 2 target audiences (financially tied, and untied), and mapped these on to a customer value vs development effort matrix.

Options included at a high level, but with multiple variants:

-

Multiplier: increasing the round up amount.

-

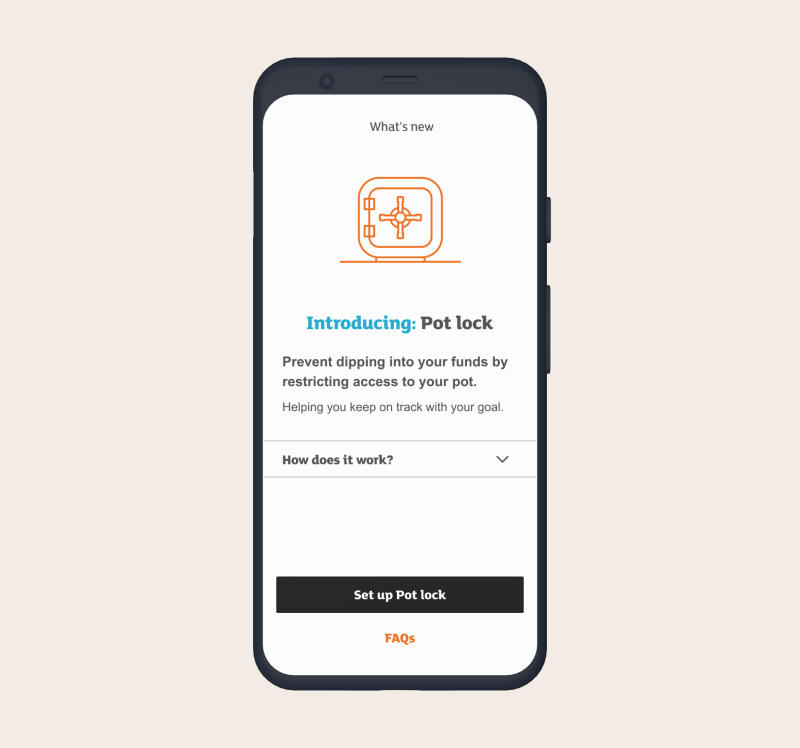

Pot lock: to remove temptation to dip in, a common behaviour in the diary study.

-

Additional contributor: add a second person to also contribute to the pot.

WHAT'S NEXT

One of the biggest hurdles has been to get 3rd party contracts signed off. Being financial services and handling money, this is no mean feat.

Now this is nearly done, we will go in to a beta trial hopefully by the end of September.

From here we will be tracking analytics around sign up, frequency customers view their pot, access their pot.

We'll also be gathering feedback from within the app and inviting customers to take part in qualitative research.

Whilst we're doing this, we'll be working on the next features.